Rumored Buzz on Medicare Agent Huntington Ny

Wiki Article

How Medicare Agent Huntington Ny can Save You Time, Stress, and Money.

Table of ContentsSome Known Details About Medicare Agent Huntington Ny 6 Easy Facts About Medicare Agent Huntington Ny ExplainedHow Medicare Agent Huntington Ny can Save You Time, Stress, and Money.An Unbiased View of Medicare Agent Huntington Ny

Does this mean that the insurance policy from restricted agents is bad? Not necessarily. Some insurance provider will just collaborate with restricted agents, and they may have some insurance coverage intends that are an excellent suitable for some individuals. Working with a captive representative out of need can be a suitable prepare for people that can completely do their research as well as understand precisely what they desire.If you know that you want a Medicare plan that will certainly be available with a representative-- like a Part C or Component D plan-- after that you ought to begin looking for a representative as quickly as feasible. Numerous insurance coverage representatives end up being bewildered throughout as well as quickly prior to significant enrollment durations, like the Open Enrollment Period.

If you have actually currently made a decision that you desire Component C and/or Component D insurance prior to your First Enrollment Duration, then you should seek an insurance agent throughout that time. Since Preliminary Registration differs from person to individual, it's more probable that they will be offered to commit even more time to your needs.

3 Simple Techniques For Medicare Agent Huntington Ny

Use a system that places the CMS needed disclaimer, plainly, on any type of landing web page, web site or email sent by TPMO, or their "first rate, downstream or related" entities, or "FDRs." Make use of a compliance system that: Displays the needed range of appointment as a document for all advertising appointments by means of a recording for every CMS possibility.Makes sure that you protect Medicare recipients, by guaranteeing that the beneficiaries obtain exact as well as easily accessible approved information concerning their Medicare insurance coverage. Can validate that beneficiaries recognize the item, including the guidelines appropriate under the enrolled plan by a recording of the telephone call that reveals the duration of each component of the discussion and also the e-mail confirmation offered after the call.

The system should likewise assist you ensure efficiency compliance by Medicare Benefit organizations and FDRs about any kind of state examination right into an individual's conduct. You'll require the ability to track TPMO advertising and marketing as well as lead-generation calls with recipients, and that can offer you records available that stop working to adhere to the CMS standardized please note standards.

An Unbiased View of Medicare Agent Huntington Ny

The clock is ticking, as well as that's why agents need to begin preparing read this article to be in compliance by Oct. 1. ... (Photo: bbernard/Shutterstock).7 hassle-free health care areas in Dane Area, including Madison, Middleton, Fitchburg, Stoughton, Monona, and De, Forest-Windsor Accessibility to Unity, Factor Wellness, Meriter in Madison, a 448-bed neighborhood hospital providing a full series of clinical and surgical solutions

Below is a web link to a file including hop over to these guys the quantities that firms pay independent agents/brokers to offer their Medicare medicine and health insurance plan. Firms that contract with Medicare to offer healthcare coverage or prescription medicines typically utilize agents/brokers to sell their Medicare plans to Medicare recipients. Sometimes these agents/brokers are staff members of the acquired business. Medicare agent Huntington NY.

Usually, agents/brokers receive an initial settlement in the initial year of the plan (or when there is an "unlike plan type" registration modification) as well as fifty percent as much for years two (2) and beyond if the participant stays enrolled in the plan or make a "like plan kind" enrollment modification. Agents/brokers need to be licensed in the State in which they do service, every year complete training and also pass an examination on their knowledge of Medicare as well as wellness and also prescription medication plans, and also adhere to all Medicare marketing regulations.

Some Known Facts About Medicare Agent Huntington Ny.

The details consisted of in this documents has columns for every Medicare plan with the adhering to information: State, area, firm name, strategy name, whether the business makes use of independent agents or otherwise, the amount(s) paid to independent representatives for offering the strategy in the first year of registration complying with the sale, various other plan identification numbers, and whether the plan details showed needs modification.S. Hrg. 110-207 MEDICARE ADVANTAGE MARKETING AND ALSO SALES: THAT HAS THE ADVANTAGE? ======================================================================= HEARING before the SPECIAL COMMITTEE ON AGING UNITED STATES SENATE ONE HUNDRED TENTH CONGRESS FIRST SESSION WASHINGTON, DC MAY 16, 2007 Serial No. 110-8 Printed for the usage of the Unique Committee on Aging Available via the Globe Wide Web: index.

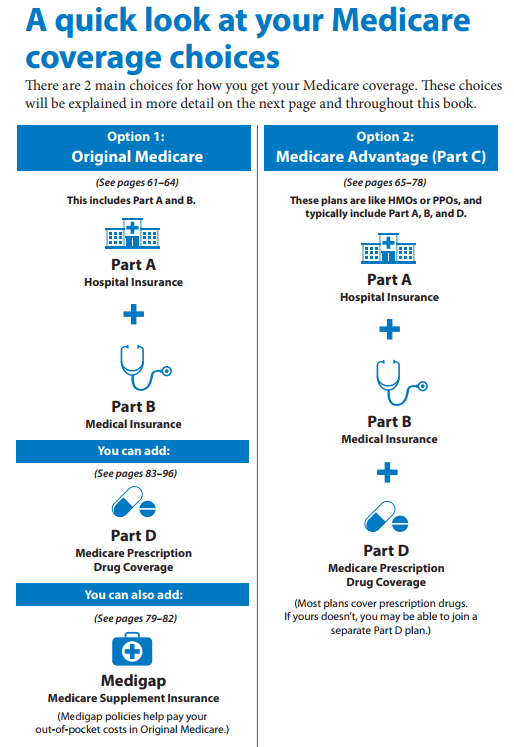

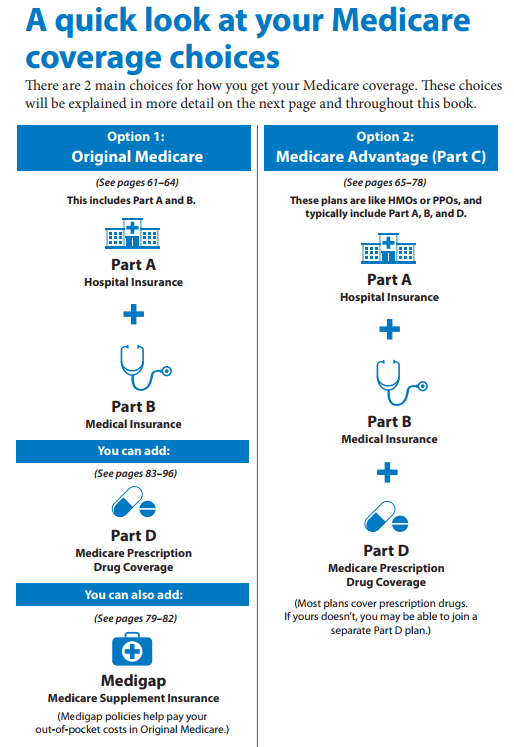

For those of you not acquainted with Medicare Benefit prepares, they are private-plan options varying from managed care to exclusive fee-for-service strategies, which are offered to Medicare beneficiaries as an alternative to standard Medicare. Seniors here have been removed from standard Medicare without their knowledge, authorized onto plans that they can not pay for, mislead concerning coverage and also told that their physicians approve these strategies when, in reality, they do not. Just as seriously, many insurance-sales representatives simply do not comprehend the important distinctions between traditional Medicare and the wide variety of other strategies readily available to seniors, consisting of the Medicare Benefit prepares that they are peddling.

Report this wiki page